Why Online Payments Matter More Than Ever

In Canada's rapidly evolving business landscape, small businesses and nonprofits can no longer afford to operate without streamlined, digital payment options. With 86% of transactions in Canada now digital and over half of consumers unwilling to return to a business without modern payment options, the message is clear: your business needs an online payment strategy.

Enter Zoho Checkout, an intuitive, secure, and highly customizable solution that helps small businesses and nonprofits create branded checkout pages, automate payment collection, and integrate seamlessly with accounting and CRM systems. This guide explores how Zoho Checkout stacks up against other industry players like Stripe, PayPal, Square, and Shopify Payments while demonstrating why it’s especially powerful for Canadian businesses.

What Is Zoho Checkout?

Zoho Checkout is a cloud-based payment solution designed to help businesses accept one-time or recurring payments through customizable, no-code checkout pages. Whether you're a consultant, a nonprofit collecting donations, or a business selling services or memberships, Zoho Checkout gives you the tools to get paid faster and with less friction.

Key Features

- Hosted Payment Pages: Easily create branded, no-code pages for one-time or recurring payments.

- Recurring Billing: Automate subscriptions, donations, and instalment payments with retry logic for failed transactions.

- Custom Branding: Add your logo, colour scheme, and page content. Remove Zoho branding on paid plans.

- Third-Party Integration: Connect with Stripe, Square, PayPal (via Braintree), and other gateways.

- Automation & Alerts: Receive real-time notifications and integrate with Slack, Zoho Books, Mailchimp, and more.

Use Cases

- Professional services collecting consultation or project fees

- Nonprofits accepting donations or membership dues

- Training organizations collecting event or course registration fees

- Subscription-based businesses offering digital services or physical products

Who Benefits From Zoho Checkout?

Zoho Checkout isn't just for tech-savvy teams. It delivers powerful capabilities for a variety of roles across industries:

Business Owners & Executives

- Get paid faster and monitor revenue in real-time.

- Automate back-end accounting with Zoho Books.

Finance & Accounting Teams

- Streamline bookkeeping with direct integration into your small business accounting software.

- Automatically generate invoices and apply provincial GST/HST tax rules.

Sales & Marketing Professionals

- Share payment links directly with clients or embed on landing pages.

- Capture payer information to nurture leads via Zoho Campaigns or Mailchimp.

Website Admins & Developers

- Embed hosted checkout pages with zero coding.

- Use QR codes for mobile-friendly, on-the-spot payments at events or storefronts.

Industry Use Cases: Who Needs Zoho Checkout?

Zoho Checkout meets the needs of many industries, especially those that depend on timely payments and recurring billing.

1. Nonprofits and Charities

- Problem: Limited staff and resources to collect recurring donations or track one-time contributions.

- Solution: Custom donation pages with flexible donation amounts, recurring gift options, and automated donor receipts.

- Why it Works: Nonprofits can embed donation forms, accept credit cards, and sync data with Zoho Books or email campaigns.

2. Professional Services (Consultants, Lawyers, Agencies)

- Problem: Manual invoicing delays and inconsistent cash flow.

- Solution: One-click payment links for project deposits, consultations, or retainer fees.

- Why it Works: Collect payments before starting work and automate follow-ups for recurring clients.

3. Membership-Based Businesses (Gyms, Clubs, Digital Services)

- Problem: High churn from failed or missed recurring payments.

- Solution: Automated subscription billing with retry logic and customer notifications.

- Why it Works: Businesses retain customers with less effort, while members enjoy uninterrupted service.

4. Education & Training Providers

- Problem: Complex registration processes and limited payment options.

- Solution: Branded registration pages tied to course or workshop fees.

- Why it Works: Makes it easier for students to enroll and pay in a single step.

5. E-Commerce & Retail Without Full Online Stores

- Problem: Don’t need (or can’t afford) a full Shopify-like store but still want to sell online.

- Solution: Product-specific checkout links shared via email, social media, or QR code.

- Why it Works: Accept payment without the overhead of managing an entire store platform.

Pain Points Without a Modern Checkout Solution

Before implementing Zoho Checkout, many businesses face these common issues:

Manual Invoicing Woes

- Creating and tracking invoices manually wastes time.

- Payments often go unpaid or are delayed due to friction.

Missed Revenue from Failed Recurring Payments

- Subscription-based businesses often lose customers due to failed credit cards.

- Without automatic retry or alerts, revenue quietly leaks.

Disconnected Tools & Fragmented Data

- Using PayPal, spreadsheets, and separate accounting tools leads to errors.

- Data doesn’t sync automatically, creating gaps and duplicate entry.

Limited Customization & Unprofessional Branding

- Many businesses use third-party payment links that feel disconnected from their brand.

- This affects customer trust and conversions.

Compliance & Privacy Headaches

- Many small businesses lack PCI-compliant infrastructure.

- Canadian data privacy laws (PIPEDA) require local or compliant data handling.

Zoho Checkout solves these with:

- Secure, encrypted payment handling

- Canadian data centers for privacy compliance

- Branded, hosted payment pages

- Integration with Zoho Books, Campaigns, Slack, and more

- Automated workflows and retry logic for recurring payments

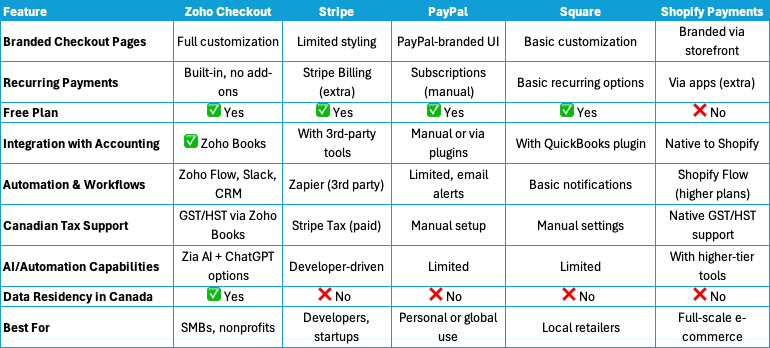

Zoho Checkout vs. Other Payment Platforms

Integrations, Automation & AI: The Ecosystem Advantage

Zoho Checkout’s strength isn’t just in processing payments, it’s how it integrates with the broader Zoho ecosystem and automates what other tools leave manual.

Key Integrations

- Zoho Books: Automatically syncs transactions for tax, reporting, and reconciliation. Supports GST/HST rules by province.

- Zoho CRM: Add or update customer records after payment.

- Zoho Campaigns & Mailchimp: Sync payer data into email marketing workflows.

- Slack: Send instant notifications on payments, failures, or milestones.

- Zoho Flow: Automate workflows like sending documents, generating reports, or triggering onboarding steps.

Automation in Action

- Recurring Payment Management: Retry failed charges up to 3 times automatically.

- Smart Notifications: Notify sales or support teams when a large payment arrives or when a transaction fails.

- Custom Workflows: Route donation data into CRM segments or apply invoice tags based on payment pages.

AI & ChatGPT Capabilities

- Zia AI: Zoho’s intelligent assistant can provide insights into payment patterns, highlight anomalies, or predict future trends.

- ChatGPT (Optional): Paired with Zoho tools, ChatGPT can summarize feedback, flag support issues in payment notes, or streamline reporting.

Together, these tools create a powerful, low-maintenance system that helps small businesses compete at an enterprise level.

What’s New with Zoho Checkout?

As of 2024, Zoho Checkout is now fully launched and localized for Canadian businesses. This means:

- Support for CAD currency and GST/HST compliance built-in.

- Data storage in Canadian servers for PIPEDA compliance.

- Local payment gateways like Stripe available in integration plans.

- A dedicated nonprofit industry onboarding page, helping mission-driven organizations digitize donor management.

How blueCaribou Software Solutions Can Help

blueCaribou Software Solutions specializes in helping Canadian small businesses implement Zoho tools efficiently and affordably. Their services include:

- Zoho Checkout onboarding and configuration

- Custom checkout page design and branding

- Integrations with Zoho Books, CRM, and third-party platforms

- Training and support for your finance and marketing teams

- Workflow automation consulting (via Zoho Flow, Zia AI)

Whether you're a nonprofit, consultant, retailer, or training business, blueCaribou ensures your setup is optimized to boost revenue, save time, and stay compliant.

Visit https://www.mybcss.com/blogs for more examples of how they’ve helped businesses transform their back-office operations.

Next Steps

Zoho Checkout delivers enterprise-grade functionality to small businesses and nonprofits without the enterprise price tag. When paired with Canadian tax compliance, automation, AI, and deep integration with Zoho’s suite of apps, it becomes a game-changer.

- Easy setup.

- Reliable recurring billing.

- Automated accounting & CRM sync.

- Full control of your branding.

Ready to modernize your payment collection system?

Reach out to blueCaribou Software Solutions and schedule your Zoho Checkout demo today.