Introduction: Payroll Simplified for Small Business Success in Canada

Managing payroll isn’t just about cutting paycheques, it's about staying compliant, efficient, and competitive. For Canadian small businesses, choosing the right payroll software can directly impact operations, employee satisfaction, and financial accuracy.

In this article, we’ll explore how Zoho Payroll, a new and exciting entrant in the Canadian market, compares to established players like QuickBooks Payroll and SimplePay. If you’re a small business owner, manager, or advisor, this is your one-stop breakdown to make an informed decision.

What Is Zoho Payroll?

Zoho Payroll is a cloud-based payroll management solution tailored for small and mid-sized businesses. Designed with simplicity and compliance in mind, it offers full-service payroll processing in Canada, including:

- T4 and RL-1 generation

- Automatic tax deductions (CRA-compliant)

- Employee self-service portal

- Direct deposit processing

- Benefits management

- Customizable pay runs and bonuses

Unlike traditional systems, Zoho Payroll is part of the larger Zoho ecosystem, giving users the advantage of deep integrations with accounting, HR, CRM, and analytics tools, all in one login.

Who Benefits from Zoho Payroll?

Zoho Payroll is designed to serve cross-functional business professionals who want to streamline administrative tasks and improve collaboration across departments:

Ideal for:

- Website Admins & HR Staff: Automate pay schedules, track benefits, generate reports

- Sales & Marketing Managers: Sync commissions and bonuses automatically

- Executives & Finance Officers: Gain real-time visibility into payroll expenses

- Business Analysts: Integrate with Zoho Analytics for custom payroll insights

Productivity Gains:

- Save up to 80% of time on monthly payroll processing

- Minimize compliance risks with auto-generated CRA documents

- Increase transparency via employee portals and mobile access

What’s New: Zoho Payroll Launches in Canada

Zoho has officially launched a Canada-specific version of Zoho Payroll, with full support for:

- CRA and Revenue Quebec guidelines

- Bilingual documents (English and French)

- Canadian bank integrations

- Region-specific payroll rules and regulations

- Direct integrations with CRA’s RP accounts and automated RL-1 filings (Quebec)

Pain Points Zoho Payroll Solves

Without a modern payroll solution, Canadian businesses may face:

- Time-consuming manual entries

- Payroll errors and late submissions

- Limited visibility into payroll trends

- Compliance risks with CRA or Revenu Québec

Zoho Payroll directly addresses these challenges with automation, centralized dashboards, and compliant record-keeping.

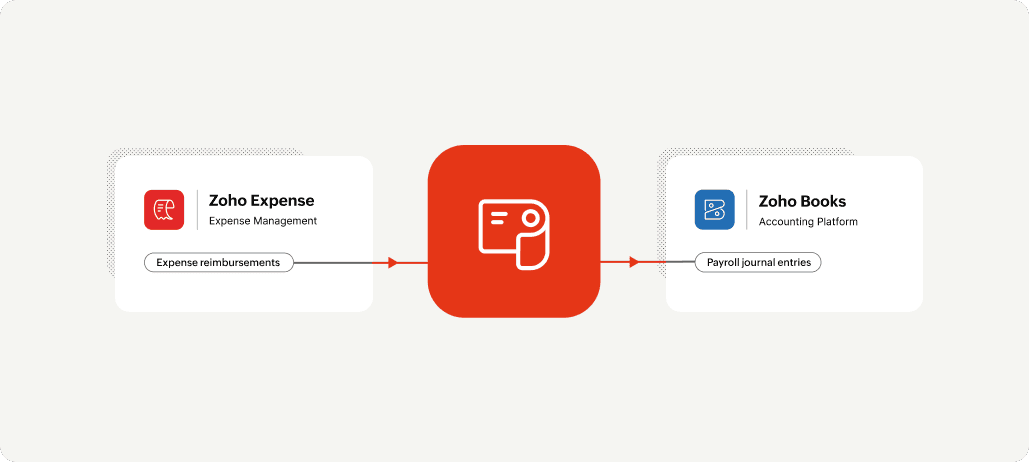

Integration Ecosystem: Plug and Play with Zoho and Beyond

Seamless Integrations:

- Zoho Books (sync expenses, GL entries)

- Zoho People (leave & attendance tracking)

- G Suite & Microsoft 365 (employee data sync)

- QuickBooks Online (bi-directional data transfer for hybrid systems)

These integrations allow for end-to-end visibility and eliminate duplicate data entry across platforms.

Key Features Breakdown

1. Full CRA Compliance

Auto-generated T4, RL-1, ROE forms

Real-time updates for tax rate changes

2. Employee Self-Service Portal

Access payslips, tax forms, leave balances

Update banking and personal info securely

3. Automation & Scheduling

Set recurring payrolls and custom bonuses

Automate holiday pay, overtime, and commissions

4. Zia AI & ChatGPT Support

Zia AI assists with real-time suggestions during form entry and validation

ChatGPT Integration (via Zoho Cliq): Summarizes meeting transcripts, improves onboarding Q&A for payroll staff

5. Real-Time Dashboards & Analytics

Export reports for stakeholders or accountants

Track payroll trends, benefits costs, and projections

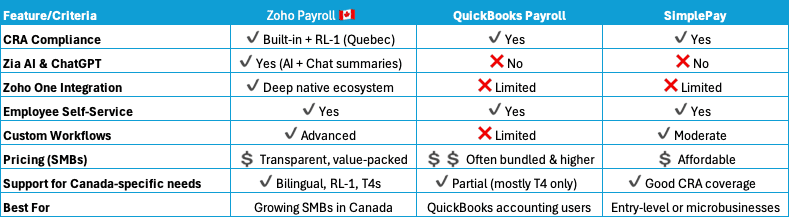

Comparison Table: Zoho Payroll vs QuickBooks Payroll vs SimplePay

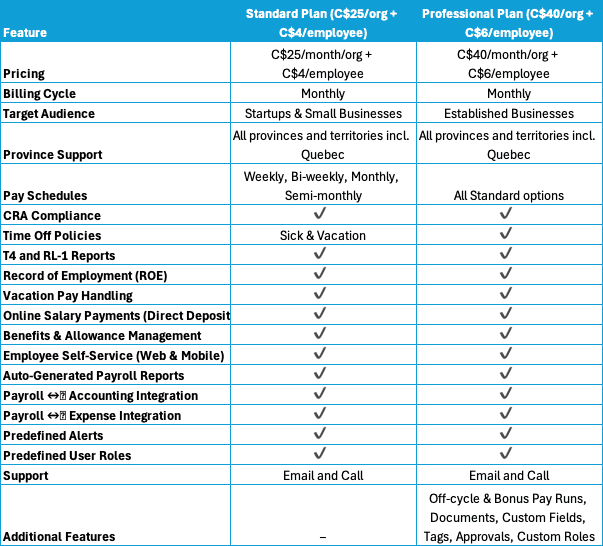

Zoho Payroll Canada: Plan Comparison Table

Use Cases Across Industries

Zoho Payroll supports a wide variety of industries, including:

- Retail & eCommerce: Sync bonuses and shift differentials

- Professional Services: Automate recurring payments for consultants

- Startups & Tech Firms: Scalable platform for remote teams

- Non-Profits: Budget-friendly payroll with compliance features

Benefits Over Other Solutions

Benefits of Zoho Payroll

- Centralized dashboard

- Deep ecosystem integrations

- CRA/RQ compliance out of the box

- AI-assisted operations

- Affordable pricing for SMBs

Challenges with Others

- QuickBooks Payroll: Often requires full QuickBooks suite for best results

- SimplePay: Limited integrations, fewer customization options

Practical Tips for Implementation

- Start with a free trial to explore automation and reporting tools

- Integrate Zoho Payroll with Zoho Books for seamless accounting

- Set up user roles and permissions for HR and managers

- Use ChatGPT via Zoho Cliq for quick employee onboarding and policy FAQs

- Consult blueCaribou Software Solutions to get tailored training and rollout support

Zoho One Advantage

When paired with Zoho One, businesses unlock:

- CRM, invoicing, HR, and analytics tools

- Unified data platform

- Centralized support and admin management

No other provider in the Canadian payroll space offers such a deep, fully native suite.

How blueCaribou Software Solutions Can Help

At blueCaribou Software Solutions, we specialize in helping Canadian businesses:

- Migrate from legacy payroll systems

- Customize and implement Zoho Payroll

- Provide training and post-launch support

- Integrate with existing tools (QuickBooks, Microsoft, G Suite)

Visit: mybcss.com/blogs to learn more

Final Thoughts

Zoho Payroll is not just a software, it's a smarter way for Canadian small businesses to manage compensation, compliance, and company culture. With intelligent automation, CRA compliance, bilingual support, and deep integrations, Zoho Payroll is setting a new bar.

Ready to upgrade your payroll experience?

Schedule a free consultation with blueCaribou Software Solutions and explore how Zoho Payroll can work for your business.